Morning Folks!!

So 13 days ago I pronounced the recession over with THIS POST! "The Finanical Recession is Over. But a Recession of the Mind Remains and Lingers."

I followed up the next day with THIS POST. "Champions and Challengers."

So I was VERY CLEAR about where I thought we were/are.

Not all were on board.

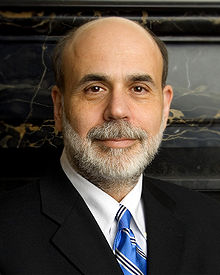

Then this week something happened. Bernanke repeated what I had said just 10 days later. Did he call me?? Now make no mistake about it, the PAIN is FAR from over. But we are at the bottom or soon will be. This summer IS the bottom and when the fall business heats up, we are off and running and the BULLS are finally loose on Main Street and not just the stock market.

So let me try again.

The Financial Recession is Over. But a Recession of the Mind Remains and Lingers. That's a GUT call. It was then supported by folks that are "Experts" just days later. Gut can trump all. Gut allows you to react before the facts unfold. That is called opportunity and opportunity is the key ingredient to making money and having a success.

Have a GREAT Day!

Rick Schwartz

Aaron Strong

The recession is over only as long as Bernanke and Obama agenda print money. As soon as the party starts, the printing stops and the balloon pops……The balloon will pop as this bull run is based on governmental control and injection into free markets.

jeff

While things are improving, our home value is still under water from

the peak of the market years back. Retail numbers looking good, but I

am wondering if people are running credit card debt and didn’t learn

there lessons.

While I like going out to dinner, having fine meals and etc, I also

need to realize things and I got rid of bad credit card debt. Pay

cash. Both cars paid off.

I like observing things when I am out and we were are a fine doing

place couple months back and some people were shocked when the bill

had arrived. They charged on the cards.I am sensing the balance wont

be paid off.

The national debt we are carrying continues to rise, will the usa be a

bankrupt nation like Greece in the next 20 years? Time will tell, but

if I had to choose the answer is a big yes. Gov spending is getting

out of control. Healthcare. People are retiring outside the united

states and the cost of living is getting a bit nutty.

Now Rick, your an exception to things, you have no worries. But the

average household making 50 to 100k should be concern and worrying. I

know we are watching things carefully.

Jeff

BullS

Thank you Thank you Obama and Bernanke, my investments has gone up 45% since 2010.

Housing prices have gone up and my neighbor sold her house for 30% more than the listed price and multiple offers.

@Jeff- it is all about location location location, like domains.

@–market is just under a correction and when the dust settles down, it will come back stronger.

John Duncan

Rick, Peter Schiff says don’t believe the hype:

http://www.youtube.com/watch?v=PVrYieNGYyw

Rick Schwartz

Well if I saw it first, then where is the hype?

They simply helped to confirm what I stated and what I see.

Time tells all.

Louise

– Rick Schwartz, Economic Outlook for 2013″Terrible, I am Very Worried” Ben Stein

When the ACA held up in the Supreme Court in mid 2012, notwithstanding the leadup predictions of economic disaster and market downturns, the foreign markets liked the news. The DJI responded! CNBC analysts were very negative about the upholding of the ACA.

But, what the world realizes, that the CNBC analysts don’t, is what is good for the citizens of the US is good for the economy of the world.

It’s like the era of no-liability economics. The big boys lead the way: Apple, Microsoft, Intel, Amazon, Starbucks, etc. with moving profits offshore to avoid taxes, and medium businesses following, even small businesses, registering their businesses in Nevada, Wyoming, or Delaware. I don’t care about your personal info, because you can’t touch my dough. Nah nah. Zero liability.

We’ll see more economic improvements once this zero liability issue among corporate leaders and their followers in avoiding taxes are addressed, if it happens.

Rick Schwartz

Point is we are in the midst of bottoming out.

I think we start heading up again in the fall and I think it continues right into 2014.

2013 does suck. So far. And we still have another couple months to go. But after that I see a much better outlook.

Louise

What do you think? Growth will be slow. You’re right, “2013 does suck. So far.” Jobs are coming back, but the pay is smaller, because jobs are increasing in the private sector, which is notorious in paying as low as possible, while the government was actually downsized since the current administration, is why many became out of work. The public wants it both ways: Downsize goverment, without job loss. It doesn’t happen that way. Actually jobs in the private sector have been going up, but they don’t pay as well.

A blurb in today’s LA Times:

Homeowner’s Spending is Muted Despite Rising Values

– Having witnessed the crash, they’re showing restraint, blunting the ‘wealth effect.”

Thought you’d appreciate the quote!

http://www.latimes.com/includes/sectionfronts/B1.pdf

UFO

The recession actually ended around Jan/Feb in the minds of at lot of investors that pushed the dow significantly up from that point. I’d already seen precursors of this as I saw a number of secondary construction developers starting putting sold signs up after they’d been for sale for a couple of years.

I know many people will find this hard to believe but 2014 through 2018 may just well be a spectactular boom that is ever bit as aggressive as the one leading to 2007. The reason for 2007 was easy credit and low interest rates. This time around interest rates will be left low (Because of political interests) and to be honest it doesn’t matter if credit is not as available because QE has stuffed so much circulation cash into the system.

Unfortunately this boom will simply widen the gap between those that own ‘assets’ and those that dont.